R&D TAX PREPARATION

Swanson Reed Specialist R&D Tax Advisors have over 30 years of consulting experience. Claiming the R&D tax credit doesn’t have to be an expensive and difficult process. The R&D tax consultants at Swanson Reed manage all facets of the R&D tax credit program with professional ease.

WE’LL DO ALL THE HARD WORK FOR YOU

Self-claiming the R&D tax credit can be time consuming and risky. A standard claim can usually be professionally complied with only 2-3 hours of staff time. Our experts will maximize the benefit you receive.

OUR OFFER IS RISK FREE

If you don’t receive a benefit, you don’t pay. You will never be out of pocket.

NO WIN = NO FEE

SPECIAL PROMO!

PAY ONLY 7.5% OF YOUR BENEFIT*

QUOTE THE PROMO CODE SR75 TO CLAIM THIS OFFER!

*Minimum fee per single project claim. Multi project claims subject to negotiation.

HOW MUCH CAN I RECEIVE?

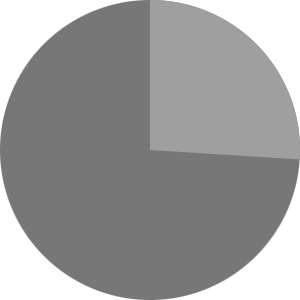

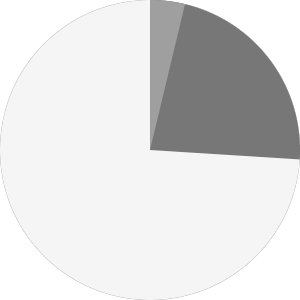

TOTAL R&D EXPENSES

YOUR CLAIM

YOUR CREDIT

OUR FEE

HOW MUCH IS AN R&D TAX CREDIT WORTH?

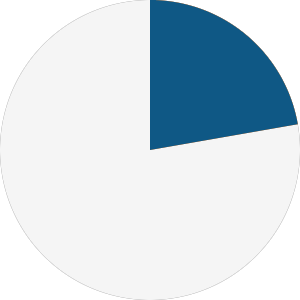

For SMEs, from 1 April 2015, the R and D tax credits claim enhancement (the enhanced deduction) was increased to 230% of the qualifying R&D expenditure incurred.

While both profitable and loss-making SMEs can choose to condense the amount of Corporation Tax they pay, a loss-making SME can realise a cash benefit of as much as 33.35p for every £1 they spend on R&D, in contrast to up to 26p per £1 spent by a profitable business. Undeniably, R&D tax credits are an increasingly multifaceted and ever-changing topic but can be a fundamental source of funding for SMEs at a vital point in their development.

WE PROVIDE FULL SERVICE R&D TAX CONCESSION ASSISTANCE FROM START TO FINISH

Swanson Reed provide eligibility assessment, claim preparation and audit services. As specialists in the R&D tax credit, we love what we do. We care about our clients and want to maximize your claim.

WHAT IS THE R&D TAX CREDIT?

The Research and Development Tax Credit was formed by HMRC to encourage firms in the UK to undertake more projects which can advance knowledge in science and technology.

Under the R&D tax credits scheme, a company involved in qualifying R&D activities can either reduce the amount of tax it pays or provide a cash sum upfront.

Essentially, if your company is taking a risk by innovating, improving or developing a process, product or service, then there is a high chance you will qualify for R and D Tax Credits.